Jewelers Mutual

How we made it personal

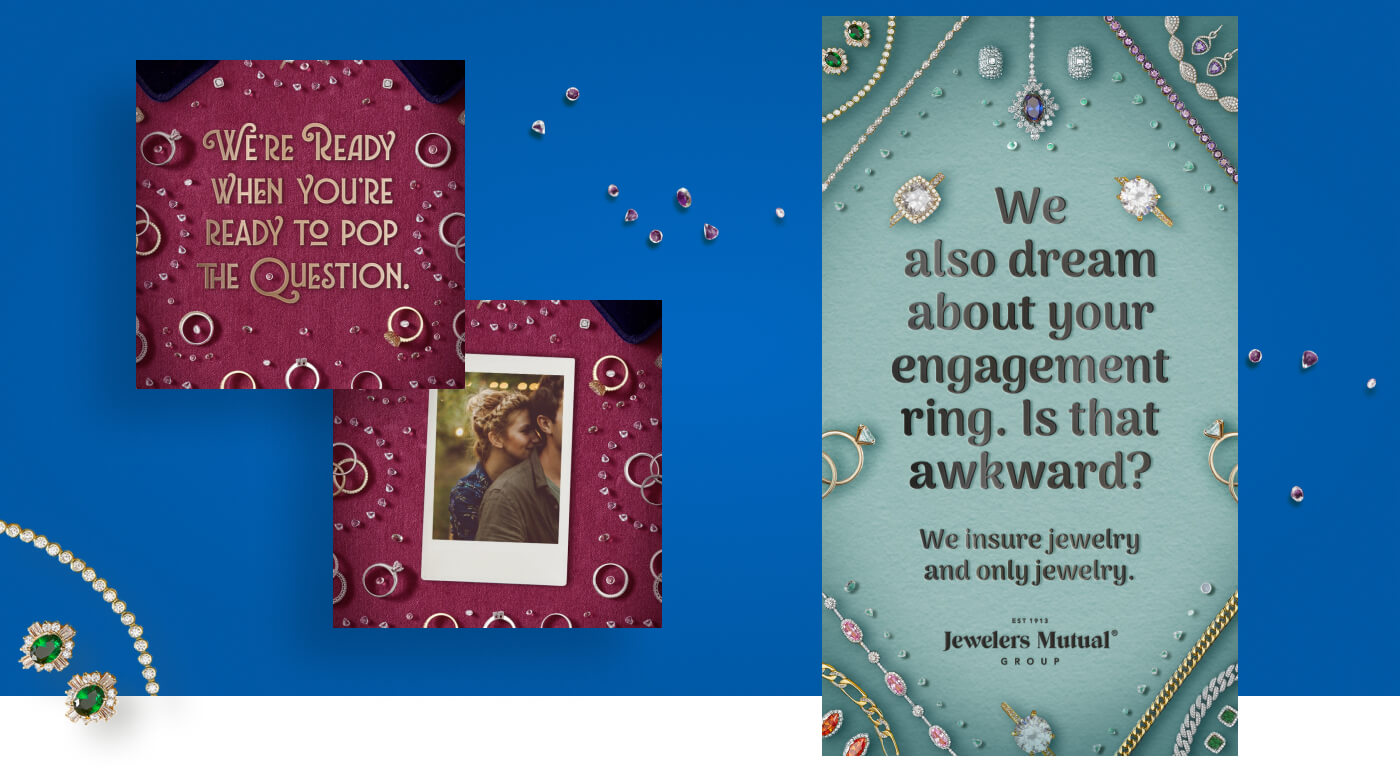

Because Jewelers Mutual insures jewelry and only jewelry, they're as obsessed with it as people are with their favorite pieces.

How it connected

115% increase in new policy conversions

Leading a 110-year old company to their best year ever.

While many know insurance companies for insuring homes, cars, boats, apartments and more, Jewelers Mutual insures jewelry and only jewelry.

To convince jewelry owners to choose dedicated jewelry coverage over the same company that insures their pipes and windows, we started by finding some common ground: Obsession.

Our researched showed that new jewelry owners form an almost instantaneous emotional attachment to their jewelry, causing borderline meltdowns if they so much as misplace their ring for a few minutes–textbook obsession. Jewelers Mutual, on the other hand, has been solely focused on insurance jewelry for more than 100 years–also textbook obsession. Through this shared jewelry obsession, we formed a connection.

- Healthcare

- CPG

- Finance

- Ecommerce

- Automotive Retail

Reaching obsessed jewelry ownerswith obsessive content.

We used online video, print, digital and social placements to recreate the feeling of obsession in 30 seconds or less. To do it, we went big, bold and meticulously ornate. We focused on every minute detail. And we weren't afraid to come off as a little jewelry crazed. Because who better to protect, repair and replace your most treasured possessions than a company that knows more about them than you?

Highly obsessive video. High profile placements.

To maximize media dollars, we chose bold placements where more affluent recently engaged and recently married couples over-indexed, like the Oscars, the Super Bowl, the 2020 Olympics and The Bachelor.

Jewelers Mutual had previously relied heavily on jeweler referrals to reach their largest new policy segment: engagement ring purchasers. To attract this niche market in larger numbers, we utilized dynamic creative optimization with dozens of triggers in a series of highly targeted digital placements.

When people put a ring on it, we helped them put insurance on it.

If a newly married guy was setting his fantasy football lineup, he was targeted with fantasy-related messaging. And if people visited our site and didn't purchase insurance, we retargeted them to come back and finish the process.

8%

YOY customer value

33%

unaided awareness

115%

new policy conversions

As an agency, we're obsessed with results.

The goal of this campaign was to expand the audience pool and drive conversion to new policies. To measure this, we looked at awareness, consideration, application starts, new policies and the value of each customer.

Through the campaign, aided awareness rose 25% and unaided awareness rose 33%, beating all competitors in the market. This showed that our creative was resonating with our desired target. Display conversion rates improved by 115% over the same time frame year-over-year, showing that our creative was generating new policy sign-ups at a vastly increased rate.

And, lastly, average policy premiums increased by 8%, showing that we reached our desired, more affluent target. In total, this led JM to sell more new policies than any other year in their 110-year history.